Renting Would Be Cheaper If…

18th August 2021

It’s easy to blame expensive rental costs on ‘greedy’ landlords, ‘devious’ letting agents and/or a profiteering build-to-rent sector but doing so would not be accurate nor help the situation.

Then we have political parties who want to introduce rental control which doesn’t work because that would just increase costs elsewhere unless they also tackle the underlying considerations of what could potentially be dysfunctional market economics.

Rent is not a number that is plucked out of thin air, there are several factors involved such as property location or supply-and-demand. We cannot effectively change rent without understanding the factors that drive it. In this opinion piece, we are looking at only one of those factors — property management — and how significant it is in impacting the price of rent.

What Drives Rent?

(1) Asset Yield

It goes without saying; owners need to make a return on their property investments. As such, the rent they set has to be profitable for them and able to compete with similar properties in their locale. This is typically calculated at a certain percentage of a property’s gross value.

This percentage, referred to by some as rental yield, is generally negotiable but ultimately decided by the competition and market state at that point in time. If an owner charges more, they will have a much harder time finding tenants. If they charge less, they reduce the yield and potentially lose out on long-term rent income.

In the UK, the average rental yield for residential properties is 3.5%. (SevenCapital, 2021) This means that, on average, if a residential property is worth £240,000 then base rent (excluding capital appreciation/depreciation) would be 3.5% of that value which equals to £8,400 annually or £700 monthly.

In this article, we are not covering ‘asset yield’ as it is an entire subject area of its own. Instead, we will focus on how property management could be made more efficient to reduce overall rental costs.

(2) Fixed Management Costs

Properties cannot manage themselves; they need looking after, servicing and regular inspections by third-parties (i.e. estate agents, build-to-rent managers) to ensure legal compliance and guidelines are met – these are covered by the fixed management fees which generally end up accounting for roughly 10-20% of the rental charge, plus VAT.

We believe these costs can be reduced considerably by improving management practices through digitisation and AI. Why do we think this?

In the IT sector, they typically charge a £25/pcm fixed rate per computer to cover management and support services. (Netitude, 2020) The price of a computer can range from £500 to £5000 which means that you would be paying a fixed management cost of only 0.5-0.05% of your computer’s price.

This is because IT support and maintenance is so efficient and largely remote, whereas property management is often paper-based, manual and usually requires on-site visits.

(3) Variable Management Costs

There are simply too many moving parts that could go wrong with a house or apartment which makes it near-impossible to calculate the costs of repairs/maintenance/trades for every circumstance.

The problem is that variable management costs often blindside tenants with hidden fees, unexpected charges and/or undisclosed price markups whenever anything goes unexpectedly wrong.

If property management were simply more efficient and transparent, it would reduce the variability of these costs significantly. And it would also help if there was legislation, similar to the tenant admin fee ban, that could prevent agents from marking up invoices from suppliers or trades at their own discretion.

The Problem

Independent owners are moving away from managing their rented out properties because homes are becoming more complex and reliant on estate agents, build-to-rent managers and other managing professionals.

Even so, property management is not easy because problems and costs are difficult to predict. This ends up being reflected in management costs which puts pressure on owners to increase ‘gross’ rent.

As long as management costs are a % of the rent, there is no incentive for ‘property managers’ to innovate or become more efficient. This is what we consider to be a dysfunctional market issue as it creates a conflicting relationship between owners, managing agents and tenants.

Property Management Going Forward

There are managing agencies in the UK that don’t charge variable management costs at all, instead they improve the efficiency of their management practices to make it easier for them to predict problems, anticipate charges and cover for unexpected circumstances within the set fixed fee.

Reduced variable management costs, or none at all, allow owners leverage when it comes to negotiating rent because it means they don’t have to worry about accounting for potential surprises at the most inopportune times, as is the nature of variable management costs.

‘As such, if everybody were more efficient, landlords would be able to reduce rent without being penalised, managing third-parties could save a lot of time and labour (allowing them to adopt more clients) and tenants would be happier because they’re paying less. It’s a win-win-win situation.’

Efficient Management

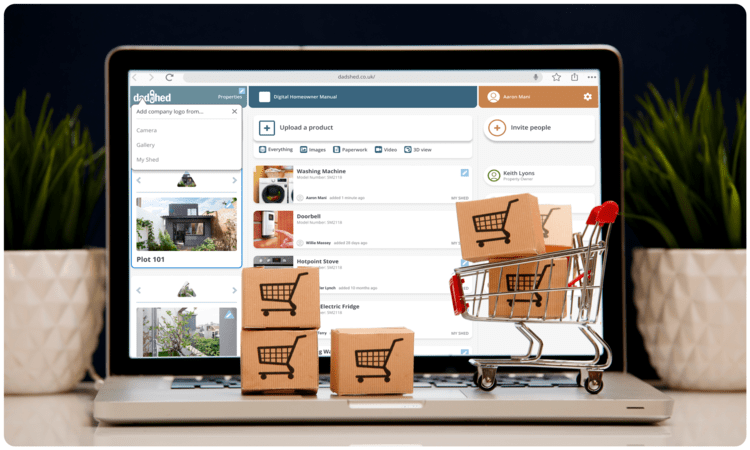

Imagine if we had a dedicated app that could store, communicate and share property information. Sounds simple, right?

This could be a digitised version of a home owner manual, property passport or management app. Below are some basic use case examples of how it might be beneficial in improving management practices and subsequently reducing rent;

LANDLORD

They could review portfolio(s) through a property owner manual digitally, as opposed to in large binders or box files, reducing printing and labour costs whilst also increasing transparency and avoiding having to constantly relay information.

MANAGING THIRD-PARTY

They could share relevant property details with suppliers/trades in advance to eliminate costs of on-site inspection visits. Artificial intelligence could also help provide predictive maintenance suggestions as opposed to reactive troubleshooting, to avoid unexpected costs.

TENANT

They could keep track of property service and maintenance history, report new issues and log records/receipts of any new purchases made for the property — reducing admin costs.

Do you agree with our insights on making rent cheaper by enabling property managers to become more efficient? Are we perhaps being biased, overly simplistic or ambitious? If you are an agent or BTR manager, feel free to provide us your feedback.

(B025)

Make Your Business Online By The Best No—Code & No—Plugin Solution In The Market.

30 Day Money-Back Guarantee

Say goodbye to your low online sales rate!